How Many Times Can You Claim the Lifetime Learning Credit

WHO Can Merits LIFETIME LEARNING CREDIT

Search Results

Lifetime Learning Credit - IRS tax forms

Gratuitous www.irs.gov

The lifetime learning credit (LLC) is for qualified tuition and related expenses paid for eligible students enrolled in an eligible educational institution. This credit tin help pay for undergraduate, graduate and professional caste courses — including courses to acquire or amend task skills. There is no limit on the number of years you can ...

366 People Used

View all form ››

Top Results For Who Can Claim Lifetime Learning Credit

Updated ane hour agone

Who is eligible for the Lifetime Learning Credit?

All-time ttlc.intuit.com

I of the advantages of the Lifetime Learning Credit is that you can take the credit every year for college education, equally long every bit you encounter all of these qualifying requirements: You, your dependent, or a 3rd party paid qualified education expenses for higher educational activity. The eligible student is you, your spouse, or a dependent on your tax return.

472 People Used

View all course ››

The Lifetime Learning Credit: Are Y'all Eligible? - SmartAsset

Live smartasset.com

The Lifetime Learning credit is a tax credit for college expenses, though information technology tin also be claimed for tuition paid for graduate courses, vocational schools and continuing education courses. The credit is worth up to 20% of the beginning $10,000 in qualifying expenses, for a maximum credit of $two,000.

352 People Used

View all course ››

Lifetime Learning Credit - Employer Reimbursement

Top ttlc.intuit.com

Lifetime Learning Credit - Employer Reimbursement. If the amount has not been included on your W2 box ane wages, then NO, yous cannot have the lifetime learning credit. The IRS states y'all can't. Claim a credit based on qualified instruction expenses paid with tax-costless educational help, such as a scholarship, grant, or assistance provided by an ...

194 People Used

View all class ››

compare education credits | Earned Income Tax Credit

Hot www.eitc.irs.gov

There are several differences and some similarities between the American Opportunity Revenue enhancement Credit (AOTC), the Lifetime Learning Credit (LLC) and the deduction for tuition and fees. You lot can claim all iii benefits on the same render merely non for the same pupil or the same qualified expenses.

141 People Used

View all course ››

American Opportunity Tax Credit: Questions and Answers ...

Best www.irs.gov

You as well cannot claim the tuition and fees tax deduction if anyone else claims the American opportunity tax credit or the Lifetime Learning credit for you lot in the same taxable year. A tax deduction of upwards to $4,000 tin can exist claimed for qualified tuition and fees paid. Although the credit will usually event in greater tax savings, taxpayers should ...

202 People Used

View all course ››

How to Summate Your Lifetime Learning Revenue enhancement Credit on IRS ...

Live turbotax.intuit.com

The Lifetime Learning Credit, on the other hand, is nonrefundable, and then you can claim a credit only upwards to the amount of the overall tax yous owe. If y'all claim the American Opportunity Credit for a student in a given year, yous cannot also merits the Lifetime Learning Credit for the same student.

458 People Used

View all course ››

Lifetime Learning Credit Vs. Tuition and Fees Deduction ...

Now www.sapling.com

If you lot're the student, y'all can't claim the tuition and fees deduction on your own return if you're someone else'southward dependent, which as well is the instance with the tax credit. The deduction is worth up to $4,000 -- twice that of the Lifetime Learning Credit -- depending on how much y'all spent on tuition and fees.

466 People Used

View all grade ››

Video effect for who can merits lifetime learning credit

Education Credits-American Opportunity Credit &...

Didactics Tax Credits

Education 8863 and Learning Lifetime Credit in 2020

Affiliate 7 Education Tax Credit Lifetime Learning Credit

Learn How to Fill the Form 8863 Education Credits

American Opportunity Tax Credit 2014

Everything Y'all Need To Know About The American...

How To Merits A School Credit On Your Taxes

How To Convert HDFC Depository financial institution Credit Card To Lifetime Free...

Tax Deductions for College Students 2018

Tin I Write Off Udemy Grade Fee On My Taxes

Revenue enhancement Help: What Do I Do With a 1098-T? What is a Form...

How to File an Initial Unemployment Merits

Open Dental Webinar- Claim Payments

Build A Complete Project In Machine Learning | Credit...

What expenses can I include in my Self Assessment tax...

GET CREDIT FOR DONATIONS AT Tax TIME

Child Tax Credit Explained 2020

CA EDD Unemployment Q&A: Can't Certify With Claim...

Employee Retentiveness Tax Credit How to Decide Your...

What Type Of Instruction Expenses Are Tax Deductible?...

Top x Revenue enhancement Credits for Individuals 2022 | How to Claim...

Who Tin You Merits As A Dependent On Your Tax Return -...

![[FAQ Video] Can Self-employed Individuals Qualify for...](https://img.youtube.com/vi/PXdGbb7lXYg/hqdefault.jpg)

[FAQ Video] Can Self-employed Individuals Qualify for...

IRS News - What taxpayers demand to know to claim the...

Revenue enhancement Deductions You Can Claim If Y'all're Self Employed

Social Security & Divorce: Can I merits Social Security...

✅ ✅ ✅ How to Get Canva Pro Free in 2022 | Create...

What is the Earned Income Tax Credit (EIC)? | Revenue enhancement...

CA EDD How Exercise You Stop Your Unemployment Claim, Tin can...

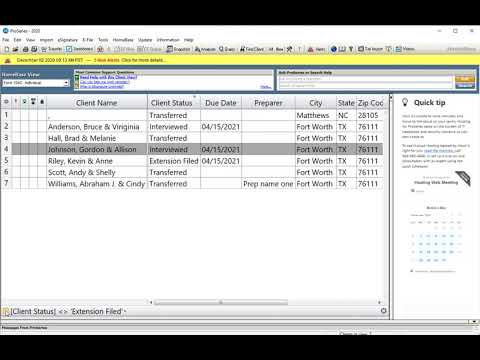

Intuit ProSeries Taxation: Filter within Client View

Non Filers & Filers Tin can Nonetheless Claim Your 1st Stimulus...

American Opportunity Taxation Credit 2022 (Tax tips for...

Step-past-Footstep Guide to Qualify for Employee Retention...

Recovery Rebate Tax Credit | How to Claim the Credit

🔴HOW TO MAKE HDFC Banking concern CREDIT Menu LIFETIME FREE |...

CA EDD: How To Tell If Yous're On A FED ED Claim, Can...

Can you get a Mortgage if you lot have Credit Charge Offs?

Can Loved Ones See Us From Heaven? The Story of the...

How To Merits Free Spotify Premium Right Now!

STIMULUS: How to Claim YOUR Recovery Rebate Taxation Credit...

Aetna Member Tools and Resources

Information technology's a Coin Affair: Loan Basics 💵

Claim Employee Memory Credit for 1st Quarter 2022 -...

SimpleTax Form8863

Higher/Grad Students and Adult Dependents | Exercise they...

Learn About the 2009 College Tax Credit - American...

What's the All-time Age to Claim Social Security 62, 66,...

Benefits for Autism and Asperger's. What you are...

Here's What the Enquiry Says nearly Lifetime Income...

HDFC Banking company Lifetime Complimentary Credit Card | Convert any HDFC...

Disability Tax Credit

For the taxpayer to merits an American opportunity credit ...

Free www.coursehero.com

The dependent cannot claim the credit. does not claim a dependent who is an eligible student on his/her taxation return (even if entitled to merits the dependent) the dependent can merits the American Opportunity or the Lifetime Learning Credit. The taxpayer cannot claim the credit based on this dependent's expenses.

261 People Used

View all course ››

News result for who tin claim lifetime learning credit

25 Secrets Elon Musk and Every Other Rich Person KnowsYour browser indicates if you've visited this link

Yahoo News

If it seems like the rich know something about money that the rest of us don't, information technology's probably because they do. There must be some reason the richest 1% of people now hold more twoscore% of the

Taxation Credit vs. DeductionYour browser indicates if y'all've visited this link

Kiplinger

The Promise credit can lower your revenue enhancement bill by upwards to $one,650 per child in the first ii years of higher (the Lifetime Learning credit ... special rules near how to claim the tuition deduction for ...

Clearing up Tax Confusion for College Savings AccountsYour browser indicates if yous've visited this link

Investopedia

The Lifetime Learning Credit ... you cannot claim the credit. Also, some states offer a tax credit for contributions to a 529 plan. For case, Indiana taxpayers can go a country income revenue enhancement ...

Firm reconciliation pecker would remove misguided revenue enhancement punishment on students with drug recordsYour browser indicates if yous've visited this link

American Enterprise Establish

High-income households are ineligible for the credit while households with no income tax liability tin can receive 40 ... is nonetheless allowed to claim the Lifetime Learning credit, only that credit ...

Taxation Prep Checklist: What to Gather Before FilingYour browser indicates if you lot've visited this link

NerdWallet

But as with deductions, you demand documentation to merits them. Here are some popular tax credits: American Opportunity and Lifetime Learning credits. These education-related credits can relieve you ...

The 5 About Controversial Provisions In The House GOP Tax BillYour browser indicates if yous've visited this link

Talking Points Memo

The legislation gets rid of the itemized deduction for medical expenses—which people can currently utilize ... the American Opportunity Tax Credit and the Lifetime Learning Credit, which benefit ...

Tax Credits Not to MissYour browser indicates if you've visited this link

Houston Chronicle

Workers who earn less than a certain maximum income can employ for revenue enhancement ... Another instance is the lifetime learning credit, which allows parents and students to claim up to $ii,000 a yr for ...

IRS Tax Tips-5 means to showtime didactics costsYour browser indicates if y'all've visited this link

ABC7

Higher tin can be very expensive ... you do not qualify for the American opportunity, Promise, or lifetime learning credits. You cannot claim the American Opportunity and the Hope and Lifetime Learning ...

How Practice I Choose the Right Tax Filing Status?Your browser indicates if you've visited this link

NerdWallet

Here's how your revenue enhancement filing status can affect which tax deductions and credits you can claim, so you can select ... take the American Opportunity or Lifetime Learning credit.

Can Investment Seminar Expenses Be Revenue enhancement Deductible?Your browser indicates if yous've visited this link

Houston Relate

The lifetime learning credit may allow you lot to claim up to a ... This is the same place where you tin can claim unreimbursed employee expenses such equally uniforms. Your total miscellaneous itemized ...

Tuition Argument - IRS Form 1098-TYour browser indicates if you've visited this link

William & Mary

Form 1098-T is intended to assistance you lot, or the person who may claim you every bit a dependent, in determining whether a tuition and fees deduction can exist taken or an education credit, such as the Lifetime Learning credit and the American Opportunity Credit ...

Tax FAQsYour browser indicates if you've visited this link

Michigan Technological University

Previous years' 1098-T forms can be plant there as well ... If I receive a 1098-T, does that mean I qualify for the Lifetime Learning Credits or other revenue enhancement benefits? Non necessarily. There are many eligibility requirements and restrictions with these ...

1098-T Frequently Asked QuestionsYour browser indicates if yous've visited this link

Sacramento Country University

Each student and/or their parents must make up one's mind eligibility for, calculation of, and limitation on the tuition and fees deduction or the pedagogy credits (promise or lifetime ... merits a tuition-and-fees deduction or an instruction-related tax credit. Tin ...

Carson Metropolis resident Karen Hinton inducted into National 4-H Hall of FameYour browser indicates if you've visited this link

Carson At present

Karen Hinton, dean and manager emeritus of University of Nevada, Reno Extension, and current Carson City resident, was inducted into the National four-H Hall of Fame this calendar week, for her lifetime achievements and contributions to 4-H,

The End of Student Loan Forbearance Will Be Tougher on WomenYour browser indicates if you've visited this link

The Bismarck Tribune

Women could see their lifetime earnings ... historic period child switched to learning from abode. The two of you couldn't manage to take intendance of the kids and keep your jobs. Who tin you expect to exit ...

Global perspectives on insurtechsYour browser indicates if yous've visited this link

McKinsey & Company

Insurtech growth is driving innovation and disruption in the industry. Four McKinsey experts hash out the electric current state and the futurity evolution of the field.

Key Banks can do a lot fast. Will information technology be their downfall?Your browser indicates if you've visited this link

Mint

From Washington to Wellington, policy makers swiftly deployed tools developed during the global financial crunch and found new ways to shore up credit ... lifetime crunch, while most detractors ...

How innovation can make the Britain a global leader in offshore windYour browser indicates if you lot've visited this link

IET

Home to a third of the world's offshore wind farm installations and more installed capacity than any other country, the UK has clearly staked a claim every bit an ... receive over its lifetime to break fifty-fifty. The right IO&M innovations can reduce these costs ...

Microsoft and Nvidia team upwards to train one of the world's largest language modelsYour browser indicates if you lot've visited this link

VentureBeat

In automobile learning ... curation can't completely address. In a paper, the Middlebury Institute of International Studies' Centre on Terrorism, Extremism, and Counterterrorism merits that ...

Social Security Myths You Need to Watch Out ForYour browser indicates if you've visited this link

AOL

Myth No. two: You Can Wait Until Retiring Before Thinking Nigh Social Security Long before you retire, try to learn about the Social Security benefits for which you lot are eligible. Too many people ...

Don't let Social Security steer you wrongYour browser indicates if you've visited this link

Tampa Bay Times

"They don't tell you, 'Hey, over your lifetime ... People can brainwash themselves by visiting Social Security's recently redesigned site and learning how the various benefits work, Franklin ...

Lifetime Learning Credit 2021: Income limit and eligibilityYour browser indicates if you've visited this link

MARCA

while the Lifetime Learning Credit (LLC) is the i for which it's easier to qualify. The disadvantage of the LLC is that information technology is not refundable, which ways that you tin can but utilize it for taxes you ...

What to Know Most the Lifetime Learning CreditYour browser indicates if you've visited this link

U.S. News & Globe Report

"Yous can employ it forever," says Miklos Ringbauer, certified public auditor and chief at MiklosCPA, based in Los Angeles. The lifetime learning credit is probable the credit y'all would claim if ...

A Revenue enhancement Break for Grad SchoolYour browser indicates if you've visited this link

Kiplinger

In that location'due south no limit to the number of years that each pupil tin claim the Lifetime Learning Credit. You lot can claim the credit for yourself, your spouse or your dependent. If you lot file your ain tax ...

Education Tax CreditYour browser indicates if you lot've visited this link

Investopedia

The lifetime learning credit tin can be used to offset costs related to undergraduate, graduate, or professional person degrees. You lot cannot claim both the AOTC and the lifetime learning credit for the same ...

A Guide to Educational Tax Credits and DeductionsYour browser indicates if you've visited this link

U.Southward. News & Globe Study

There's no limit to the number of years that you can claim the Lifetime Learning Credit. You can take the Lifetime Learning Credit for graduate school or undergraduate expenses, and you don't accept ...

Revenue enhancement Credit vs. DeductionYour browser indicates if you've visited this link

Kiplinger

The Hope credit can lower your tax bill by up to $1,650 per child in the first 2 years of college (the Lifetime Learning credit ... special rules about how to claim the tuition deduction for ...

25 Secrets Elon Musk and Every Other Rich Person KnowsYour browser indicates if you've visited this link

Yahoo News

If it seems similar the rich know something nearly money that the rest of us don't, it'due south probably because they do. There must exist some reason the richest 1% of people now agree more than forty% of the

Tax Deduction of Education As a Business ExpenseYour browser indicates if you've visited this link

Houston Chronicle

For instance, if you accept $v,000 of expenses and employ them to claim the Lifetime Learning Credit, you can't besides utilize that aforementioned $v,000 as a business expense. If you're self-employed, you report your ...

House reconciliation bill would remove misguided tax penalty on students with drug recordsYour browser indicates if you've visited this link

American Enterprise Institute

High-income households are ineligible for the credit while households with no income tax liability can receive forty ... is still allowed to claim the Lifetime Learning credit, but that credit ...

Revenue enhancement Prep Checklist: What to Gather Earlier FilingYour browser indicates if you've visited this link

NerdWallet

Merely as with deductions, yous need documentation to claim them. Here are some popular tax credits: American Opportunity and Lifetime Learning credits. These education-related credits can salvage you ...

The five Well-nigh Controversial Provisions In The Business firm GOP Taxation BillYour browser indicates if you've visited this link

Talking Points Memo

The legislation gets rid of the itemized deduction for medical expenses—which people tin currently utilize ... the American Opportunity Taxation Credit and the Lifetime Learning Credit, which benefit ...

IRS Tax Tips-5 ways to first education costsYour browser indicates if you've visited this link

ABC7

College tin be very expensive ... yous do not qualify for the American opportunity, Hope, or lifetime learning credits. You cannot merits the American Opportunity and the Hope and Lifetime Learning ...

How Practice I Choose the Correct Tax Filing Status?Your browser indicates if yous've visited this link

NerdWallet

Here's how your tax filing condition can affect which tax deductions and credits you can claim, so yous can select ... take the American Opportunity or Lifetime Learning credit.

Can Investment Seminar Expenses Be Tax Deductible?Your browser indicates if you've visited this link

Houston Chronicle

The lifetime learning credit may allow y'all to claim upwards to a ... This is the same identify where you tin claim unreimbursed employee expenses such equally uniforms. Your total miscellaneous itemized ...

Tuition Statement - IRS Class 1098-TYour browser indicates if you've visited this link

William & Mary

Form 1098-T is intended to help you, or the person who may merits you as a dependent, in determining whether a tuition and fees deduction can exist taken or an education credit, such every bit the Lifetime Learning credit and the American Opportunity Credit ...

Tax FAQsYour browser indicates if y'all've visited this link

Michigan Technological University

Previous years' 1098-T forms tin can be institute there besides ... If I receive a 1098-T, does that mean I qualify for the Lifetime Learning Credits or other tax benefits? Not necessarily. There are many eligibility requirements and restrictions with these ...

1098-T Frequently Asked QuestionsYour browser indicates if you lot've visited this link

Sacramento State University

Each pupil and/or their parents must determine eligibility for, calculation of, and limitation on the tuition and fees deduction or the education credits (promise or lifetime ... claim a tuition-and-fees deduction or an education-related revenue enhancement credit. Can ...

Carson City resident Karen Hinton inducted into National iv-H Hall of FameYour browser indicates if you've visited this link

Carson Now

Karen Hinton, dean and manager emeritus of Academy of Nevada, Reno Extension, and current Carson Urban center resident, was inducted into the National 4-H Hall of Fame this week, for her lifetime achievements and contributions to 4-H,

Tax CreditYour browser indicates if y'all've visited this link

Investopedia

A revenue enhancement credit is an amount of money that taxpayers can decrease directly from taxes ... taxation credits include credits for adoption, the Lifetime Learning Credit, the Child and Dependent Care Credit ...

The End of Student Loan Abstinence Will Be Tougher on WomenYour browser indicates if you've visited this link

The Bismarck Tribune

Women could come across their lifetime earnings ... historic period child switched to learning from home. The 2 of you couldn't manage to take care of the kids and keep your jobs. Who can you await to get out ...

Global perspectives on insurtechsYour browser indicates if yous've visited this link

McKinsey & Company

Insurtech growth is driving innovation and disruption in the industry. Four McKinsey experts discuss the current state and the time to come development of the field.

Central Banks can do a lot fast. Will it be their downfall?Your browser indicates if y'all've visited this link

Mint

From Washington to Wellington, policy makers swiftly deployed tools adult during the global financial crisis and institute new ways to shore up credit ... lifetime crisis, while nigh detractors ...

How innovation can make the UK a global leader in offshore windYour browser indicates if yous've visited this link

IET

Home to a tertiary of the world'south offshore wind farm installations and more than installed chapters than any other land, the U.k. has clearly staked a merits as an ... receive over its lifetime to break fifty-fifty. The correct IO&Chiliad innovations can reduce these costs ...

Microsoft and Nvidia team upwards to train one of the world's largest language modelsYour browser indicates if you lot've visited this link

VentureBeat

In machine learning ... curation tin can't completely accost. In a paper, the Middlebury Institute of International Studies' Centre on Terrorism, Extremism, and Counterterrorism claim that ...

Social Security Myths You Need to Spotter Out ForYour browser indicates if you've visited this link

AOL

Myth No. ii: Yous Can Await Until Retiring Before Thinking About Social Security Long before you retire, effort to learn about the Social Security benefits for which you are eligible. Too many people ...

Don't permit Social Security steer you wrongYour browser indicates if you've visited this link

Tampa Bay Times

"They don't tell you, 'Hey, over your lifetime ... People can educate themselves by visiting Social Security's recently redesigned site and learning how the diverse benefits piece of work, Franklin ...

Lifetime Learning Credit: How to Salvage Money on Your Taxes ...

Hot studentloanhero.com

The IRS offers the Lifetime Learning Credit equally one of its measures to offset the cost of an instruction. If you lot paid educational expenses in the past year for yourself, your spouse or your dependent, you tin claim this tax credit. The Lifetime Learning tax credit reduces your taxation liability by upward to 20% of the first $10,000 you paid in educational ...

164 People Used

View all course ››

Guide to Didactics Tax Credits & Deductions

Costless www.financialnews.cc

An education tax credit, sometimes called a college tax credit, helps with the cost of college education by reducing the amount you owe in taxes. You lot tin tap into two types of tax credits: the American Opportunity Tax Credit (AOTC) and the Lifetime Learning Credit (LLC). Permit'south go over the two types of tax credits beneath.

468 People Used

View all course ››

Lifetime Learning Credit: Tax Break on Ed Costs | Credit ...

Salve world wide web.creditkarma.com

To claim the lifetime learning credit for 2022 taxes, your modified adjusted gross income must be less than $67,000 if you're a single tax filer or less than $134,000 for married filers. You tin can't merits the credit if y'all file taxes as married filing separately. Only single filers with a MAGI of $58,000 or less ($116,000 or less for married ...

203 People Used

View all course ››

Mayhap You Like

Devient consultant et architect android developpeur(Kotlin)

Payroll Processing in India - For Beginners

The Definitive CompTIA Certified Technical Trainer (CTT+)

Cuban Salsa - Accented Beginners

Master Gerunds and Infinitives | Advanced English Grammar

Curso de Sistema Escolar com PHP7 PDO eastward Ajax

How To Network Strategically: create a networking strategy!

プロジェクト成功のカギ!プロマネが教える進捗管理(基礎&EVM)

FAQs

How can I join online schoolhouse?

Students who are eager to pursue vocational careers, but don't have the time to sit in a traditional classroom, can rest bodacious that their goals are still within reach. Online teaching at the career or vocational level is not only bachelor, information technology is gaining traction among students who recognize the value of earning their education without sacrificing work, family obligations and more.

Can I put online courses on my resume?

Yes. It is a expert thought to put Relevant completed online courses on your resume, specially if you have a document for it. In the Pedagogy department, write most your formal education - namely, your Available and Masters degrees.

Is online study adept or bad?

Online schooling is a skillful option if you lot exercise good fourth dimension direction and follow a well prepared time tabular array. Consider it every bit a smashing opportunity to acquire more than and learn better! Every bit we all know backlog of everything is bad. Everything has a limit if u doing it in efficient and constructive way.

What are the disadvantages of online schoolhouse?

1. Online courses require more than fourth dimension than on-campus classes.

2. Online courses require good time-management skills.

three. Online courses require yous to be an active learner.

4. Online courses give yous more than liberty, possibly, more than you tin handle!

5. Online courses require yous to be responsible for your own learning.

Popular Search

About who can claim lifetime learning credit

who tin can claim lifetime learning credit provides a comprehensive and comprehensive pathway for students to see progress after the end of each module. With a team of extremely dedicated and quality lecturers, who tin can merits lifetime learning credit will not simply be a place to share knowledge but besides to help students become inspired to explore and discover many creative ideas from themselves. Clear and detailed grooming methods for each lesson will ensure that students tin acquire and utilize knowledge into exercise hands. The teaching tools of who tin merits lifetime learning credit are guaranteed to exist the most complete and intuitive.

- Search Courses By

- All Level

- Beginner

- Intermediate

- Expert

- Search Past Time

- All

- Past 24 Hours

- Past Calendar week

- Past Calendar month

Course Blogs

Schoolhouse of Bots

School of Bots School of Bots is currently known equally ane of the top chatbot pedagogy brands in the world. Information technology was born with the purpose of being a part of businesses tha...

How printed macron boxes are helpful for you?

The macaron boxes are existence used past all the bakery owners all over the world. The macaron is a cookie that is loved by people of all ages, so the confectioners brand sure they are packed well. Food items are prone to getting spoiled apace, which is another reason why they should be packed in such a mode that nothing harmful affects them. The best thing about these boxes is that they are durable and can protect the macaron against any harm even when it'southward transported from ane place to the other. When people get to consume the quality production, they return to the same brands often, which increase sales. Permit's talk over why printed macaron boxes are helpful for you lot.

The CEO Creative Reviews

Referring to the apparent destination for accessing a broad range of business resource, it is important to mention a popular make - The CEO Creative. We believe that you must have heard abo...

Courses Sale

Source: https://www.coursef.com/who-can-claim-lifetime-learning-credit

0 Response to "How Many Times Can You Claim the Lifetime Learning Credit"

Post a Comment